In the vibrant landscape of urban development in China, few entities wield as much influence as the Zhengzhou Road and Bridge Construction Investment Group Co., Ltd. This company has emerged as a cornerstone in the traffic infrastructure sector of Zhengzhou, the capital of Henan Province. However, recent reports have brought its financial struggles into the spotlight, raising concerns among stakeholders and the broader market about its sustainability.

Founded in 2003 with an initial registered capital of only 0.56 billion yuan, Zhengzhou Road and Bridge has seen significant growth over the years, now boasting a registered capital of approximately 4.56 billion yuan by March 2024. As the sole shareholder of the company, the Zhengzhou Construction Investment Group has steered the company into diverse operational fields, including not just road construction, but also engineering design, project management, and smart transportation solutions.

The company has engaged in vital construction projects that facilitate city transport. Its operational reach extends to building roads, tunnels, bridges, and highways, primarily within Zhengzhou. Notably, it operates the Zhengshao Highway, a critical thoroughfare that covers 53.25 kilometers and has been pivotal for local commuting since its completion in 2004. With the growing demand for infrastructure in urban environments, Zhengzhou Road and Bridge has attempted to diversify its revenue streams, integrating a mix of projects under the Build-Transfer (BT) model and general contracting arrangements. Yet this expansion has not come without its challenges.

Despite an impressive performance in terms of revenue over the years—16.91 billion yuan in 2021, 21.50 billion yuan in 2022, and peaking at 30.07 billion yuan in 2023—the company’s financial trajectory has turned sour, evidenced by a net profit that nosedived into the red in 2022, marking the first loss in its history. The trend has continued into 2024 with a reported revenue decline of 15.53% in the first three quarters compared to the previous year, raising alarm bells regarding its operational viability.

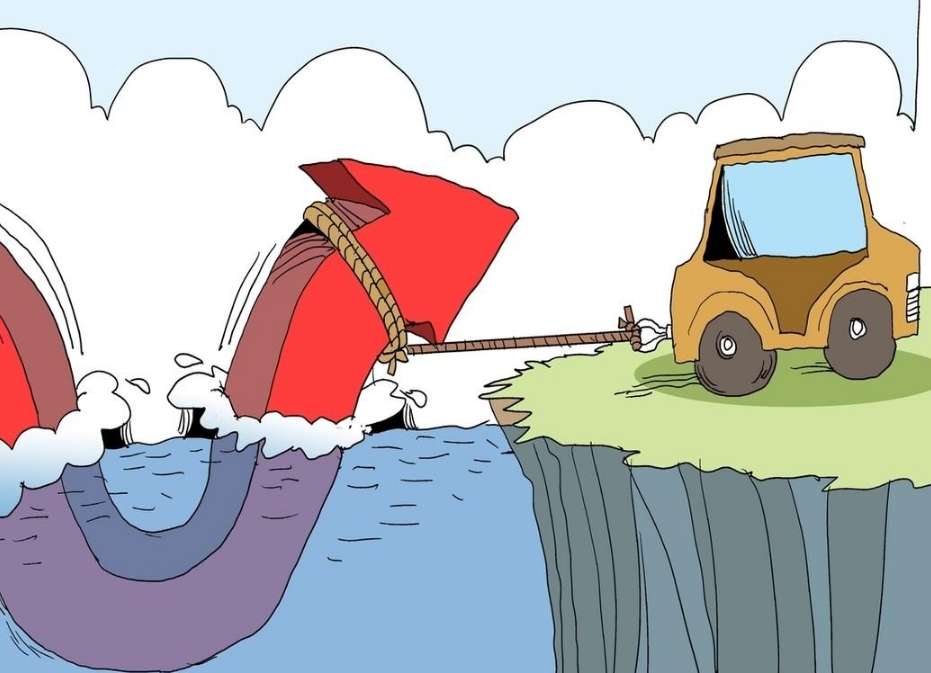

A significant portion of this downturn can be attributed to the rising levels of outstanding receivables and debts that are making it increasingly difficult for the company to maintain liquidity and meet its financial obligations. Reports indicate a disturbing rise in accounts receivable, revealing a worrying trend where the company has become reliant on uncollected payments. In fact, the amount of receivables has escalated dramatically, leading to a situation where it compromises the financial stability of Zhengzhou Road and Bridge.

The operational pressures facing the company are compounded by a lack of communication; attempts to reach out to corporate officials for comments on their financial practices went unanswered. This silence can often be a red flag, suggesting deeper issues lurking beneath the surface that investors and stakeholders ought to be concerned about. Moreover, the organization’s balance sheets reveal a substantial increase in long-term receivables, with amounts rising sharply as a proportion of total assets—indicative of cash flow struggles and potential operational inefficiencies.

Debt appearances in financial reports further underscore these troubling circumstances. Zhengzhou Road and Bridge's debt levels have soared over recent years, with assets of 206.63 billion yuan countered by debts totaling 169.29 billion yuan by the end of 2023. Its liability ratio stands alarmingly high, casting suspicion on its long-term viability, especially as the company grapples with liquidity issues that inhibit its ability to efficiently engage in operations.

This precarious financial situation is illustrated through recent public concerns. In 2024, reports surfaced about streetlights not functioning in several districts, raising eyebrows amongst residents regarding the company's project execution capabilities. The subsequent investigation revealed that Zhengzhou Road and Bridge was in a bind due to unpaid constructions, resulting in adherence to timelines being compromised and operational capabilities severely diminished.

Compounding the company’s woes is their heavy reliance on short-term financing, with liabilities climbing to approximately 116.37 billion yuan in current debts, while their liquid assets remain drastically low, further amplifying short-term insolvency risks. These statistics depict a company at risk—one that may soon struggle to meet its obligations if these trends persist. Furthermore, reports indicate that payment delays from government contracts exacerbate these issues, stalling projects and fueling the cycle of debt that Zhengzhou Road and Bridge seems increasingly embroiled within.

Analysts shed light on how high receivables specifically pose a risk to Zhengzhou Road and Bridge's operational health. The company is predominantly an asset-heavy infrastructure entity; hence, such liabilities represent not just an accounting issue but a fundamental threat to cash flow dynamics. Stakeholders worry about how prolonged delays in receivables could tarnish the company's creditworthiness and hinder future financing options—even posing risks for its existing debt refinancing arrangements.

In summary, Zhengzhou Road and Bridge stands at a crossroads where the decisions made in the coming months will critically shape its future. As the company grapples with mounting debts, rising receivables, and mounting pressure from stakeholders, it serves as a poignant case study in the broader narrative of infrastructure finance in China. The lessons learned from its pathway could illuminate challenges intrinsic to the sector, highlighting the fine line companies tread between growth opportunities and financial ruin.

Through diligence and informed scrutiny, it remains to be seen whether Zhengzhou Road and Bridge can navigate this stormy economic landscape, returning to a path of growth and sustainability. Observers from both industry and financial circles will certainly keep a close watch on its unfolding story.